DALLAS

Worldwide markets have remained highly volatile in March as the coronavirus, officially known as COVID-19, has continued its spread through Asia, Europe and the United States. Long-term retirement investors, though, should not let those fears steer them away from their efforts to invest for retirement, GuideStone® cautions.

Eleven years ago today (March 9), the market bottomed out, following the 2008–2009 market decline. During the intervening 11 years (through March 6, 2020), the market rose 452.56% — an annualized rate of 16.76%.

GuideStone Chief Strategic Investment Officer David Spika noted that an overall market decline of 10% is not unusual in presidential election years, and this year's election cycle was expected to be more disruptive than most previous election years. Anticipating that a correction was overdue for the markets, GuideStone has consistently cautioned retirement plan investors to revisit their asset allocation in light of their risk tolerance and time horizon during the market's sustained growth.

"We cannot be sure of the near-term ramifications of these events on the stock market and whether we will experience a quick bounce back (as we have seen during other corrections since 2008) or a longer-term downturn," Spika said. "Two things we will be watching closely are corporate earnings growth and global economic activity, as we believe these are the most important factors in determining how stocks trade from this point forward. If the coronavirus, oil weakness or some other unforeseen catalyst puts significant downward pressure on corporate profits, there are likely to be continued sell-offs in the market."

That said, Spika said trying to time the market rarely works in the investor's favor.

"Market sell-offs can be dangerous for long-term investors because they can trigger fear-driven 'market timing' impulses to sell out of positions," Spika said. "History has shown there's a real cost to trying to time the market."

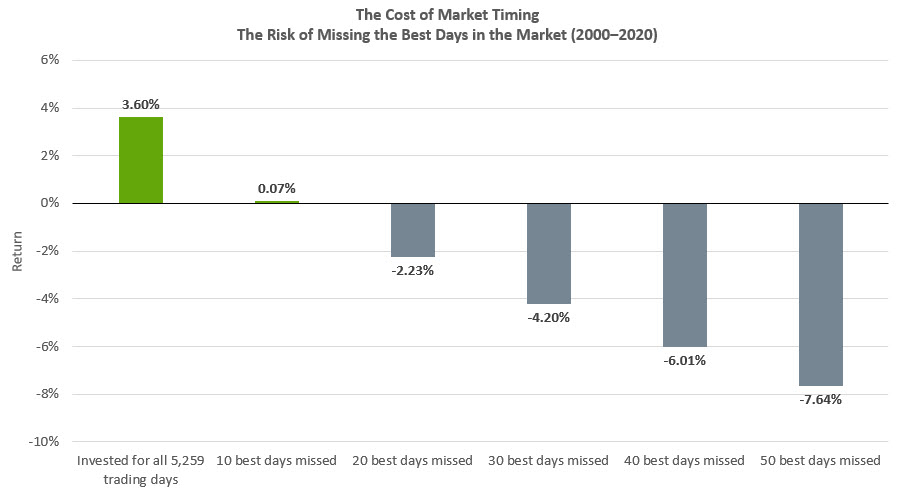

The chart below illustrates that missing the 10 best trading days in the market over the 20-year period from 2000 to 2020 would essentially eliminate an investor's gains.

Source: Bloomberg. Data displayed from January 1, 2000 through February 29, 2020. The “market” as referred to in the chart above is the S&P 500® Index. Past performance does not guarantee future results. Index used with permission. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses.

GuideStone President O.S. Hawkins echoed Spika's sentiments.

"The minute-by-minute headlines on social media and cable news can cause fear and lead to rash decision-making," Hawkins cautioned. "It's important to remember that retirement investments are a long-term goal and that the market has these periods of volatility from time to time. If a retirement plan investor wants to make changes to his or her portfolio, then consider your diversification, time horizon and risk tolerance. Then and only then should consideration of the facts, and not the emotions of the moment, drive any decisions."

GuideStone participants can receive help with their long-term investment allocations by accessing the resources on the Retirement Planning and Guidance page (GuideStoneRetirement.org/InvestmentAdvice), which include GuideStone's Investment Recommendation tool.

GuideStone recommends four basic principles for retirement plan investors:

-30-

This information is prepared by GuideStone Capital Management LLC®, a controlled affiliate of GuideStone Financial Resources®. This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Diversification is not a guarantee against loss. This information does not represent any GuideStone® product. Special risks are inherent in international investing, including those related to currency fluctuations and foreign, political and economic events.

The material represented has been obtained from sources we consider reliable, but which we cannot guarantee. It is subject to change without notice and is not intended to influence your investment decisions. This information discusses general market activity, industry or sector trends or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

All indices are unmanaged and not available for direct investment. Index performance assumes no taxes, transaction costs, fees or expenses. Past performance is no guarantee of future results.

The S&P 500® Index is a market capitalization-weighted equity index composed of approximately 500 U.S. companies representing all major industries. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of its constituents. “Standard & Poor’s®”, “S&P®”, “S&P 500®”, “Standard & Poor’s 500” and “500” are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by GuideStone.

_____________

Roy Hayhurst is director of denominational and public relations services for GuideStone Financial Resources of the Southern Baptist Convention®.

Media Contact

Roy Hayhurst

Director of Denominational and Public Relations Services

GuideStone Financial Resources of the Southern Baptist Convention®

Roy.Hayhurst@GuideStone.org | (214) 720-2141