Keeping track of complex insurance jargon and filing claims can feel stressful. For example, do you know the difference between claims-made policies and occurrence-based policies?

At GuideStone®, we want to help guide and equip you to understand property and casualty policies as you make decisions for your ministry. Here are the main differences.

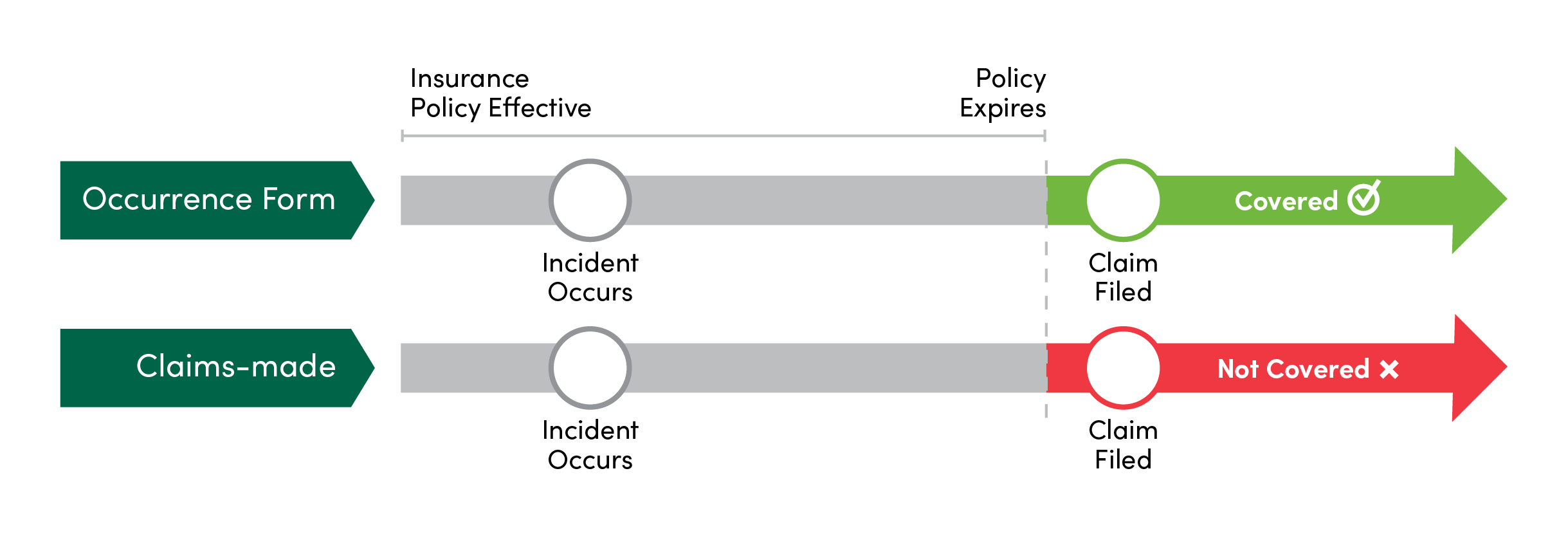

The main difference between claims-made and occurrence policies is how the coverage applies — knowing when your policy is effective and when it expires determines whether the incident will be covered. This clarity allows your ministry to be protected with lessened financial impact and minimized burdens.

If you look at the declaration pages from your commercial liability insurance policy, claims-made liability policies will generally be easy to find. It’s frequently listed at the top of the first declaration page, stating “This is a Claims-Made Policy”. It is also found in what is often called “Professional Liability”, or the liability assumed because of a profession. In the ministry context, we generally see this in the following six types of liability:

Occurrence coverage can help protect your ministry from legal action for years to come, regardless of when a claim is filed.

At GuideStone, we come alongside you with property and casualty resources, including a guide to church volunteer management and tips to help prevent discrimination and harassment. For a risk assessment or more information, contact us at InsuranceSolutions@GuideStone.org or (214) 720-2868, Monday through Thursday, from 7 a.m. to 4:30 p.m. CT and Friday, from 7 a.m. to 4 p.m. CT.

This article is for informational purposes only. It is not intended to be construed as legal advice. Readers should use this article as a tool, along with best judgment and any terms or conditions that apply, to determine appropriate policies and procedures for your church's risk management program.

*Tail coverage can be purchased from the company offering claims-made to extend the reporting period.