When it comes to saving money, feel like you can't make headway? Reality check: You can. It’s about taking small, manageable steps. Retirement may seem decades away. But to be ready for tomorrow, you have to begin saving today. Check out the useful tips below for a strong start to your savings journey.

Know the benefits of starting now.

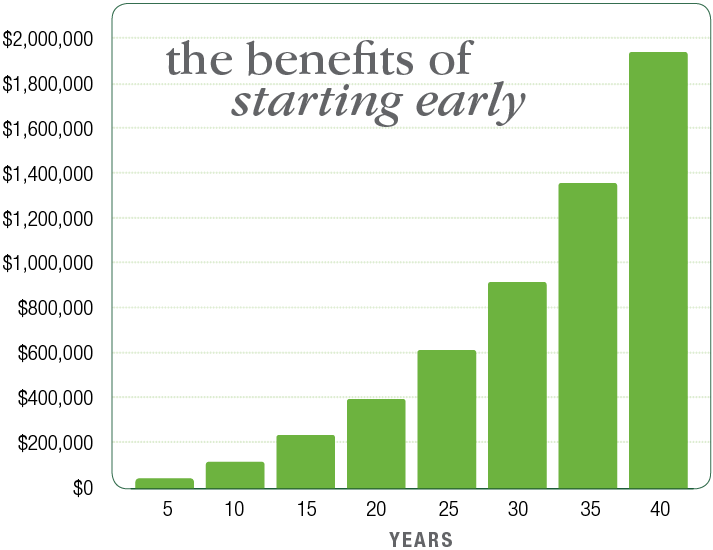

The earlier you invest in a retirement plan, the more time you allow your money to work for you. Even modest contributions can build into large savings over time.

Perks of starting early:

This is a hypothetical example that illustrates the future value of regular monthly investments for different time periods. It is based on a 25-year-old with a starting salary of $50,000, annually increasing by 3% until age 67. It assumes an annual deferral rate of 15% with an average annual return of 6%. It is presented for illustrative purposes only and does not reflect actual performance or predict future results of any particular account or investment.

Determine how much you should contribute.

GuideStone advisors recommend a 15% retirement savings goal. If this goal seems a bit daunting, begin saving 5%–10% of your salary and then increase that percentage every time you receive a raise, bonus or promotion to help you stay on track. These small annual increases can make a big difference and greatly improve the likelihood that you’ll reach your end goal. Keep in mind the compound return you’ll earn on your investment as an added incentive to start saving early.

Invest appropriately.

It's important to make sure your portfolio is comprised of investments that best align with your retirement goals and risk tolerance. We make it simple to do just that with our Investment Recommendation tool. Simply answer a few questions regarding your retirement savings goals to receive an investment recommendation that best fits your needs.

Simplify account management.

If you have accumulations from a previous employer's plan or an IRA, consider rolling them over to your retirement account. When you consolidate your accounts and streamline finances with one trusted provider, you save both time and effort. Plus, with GuideStone by your side, you can more easily maintain a diversified portfolio and track savings progress against your goals.

Advisory Services

Don't want to do it yourself? We offer a range of financial planning services, tailored investment strategies and ongoing investment management for those looking for a higher level of service. Learn more.

Start saving today — your future self will thank you.

*Financial advice provided by GuideStone Advisors, a controlled-affiliate of GuideStone Financial Resources

Other options are available besides rolling over your employer-sponsored retirement plan, including leaving the account with your previous employer. An employer-sponsored retirement plan may offer advantages investors can’t get if they roll the money into an IRA.

Advisory services offered through GuideStone Advisors®, an SEC Registered Investment Adviser. GuideStone Advisors is a controlled affiliate of GuideStone Financial Resources®. For more information about the firm, products and services, please review the GuideStone Affiliate Form CRS.