You know you need to save for retirement, but making appropriate personal retirement contributions may be hard to do all at once. In fact, many experts recommend a retirement savings goal of 15%.

If that amount doesn’t seem feasible right now, that’s okay. The key is to start where you can and continually increase your contributions over time until you achieve your goal. Our advisors suggest starting at 10%, then making percentage increases annually.

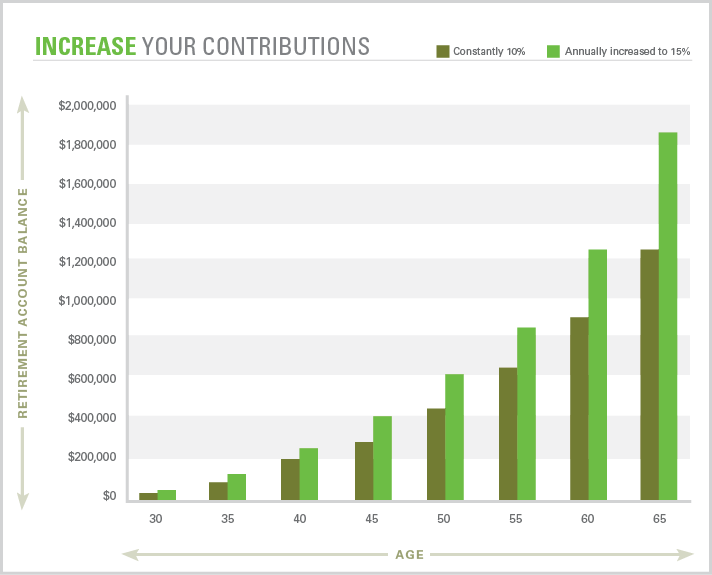

See how regularly increasing your contributions can make a difference for your retirement savings.

This is a hypothetical example that illustrates the future value of regular monthly investments for different time periods. It is based on a 25-year-old with a starting salary of $50,000, annually increasing by 3% until age 67. It assumes an average annual return of 6% and compares a consistent annual deferral rate of 10% with an annual deferral rate beginning at 10% at age 25, which increases 1% annually until age 30 when it reaches and maintains a 15% annual deferral rate. It is presented for illustrative purposes only and does not reflect actual performance or predict future results of any particular account or investment.

Start now by taking two simple steps:

You should also review the latest contribution limits to see the maximum amount you can contribute to your account this year.