Experienced professionals recommend saving 10-15% of your annual household income (this amount includes both your personal and employer contributions) for retirement. However, many workers may find it challenging to make that commitment at the beginning — so they work up to it!

The best place to start is by saving at a rate high enough to qualify for your organization’s full matching contribution. Then, commit to raising your contribution rate by at least 1% or 2% every year until you reach your contribution goal.

Annual Increases can make a big impact since you are saving and investing!

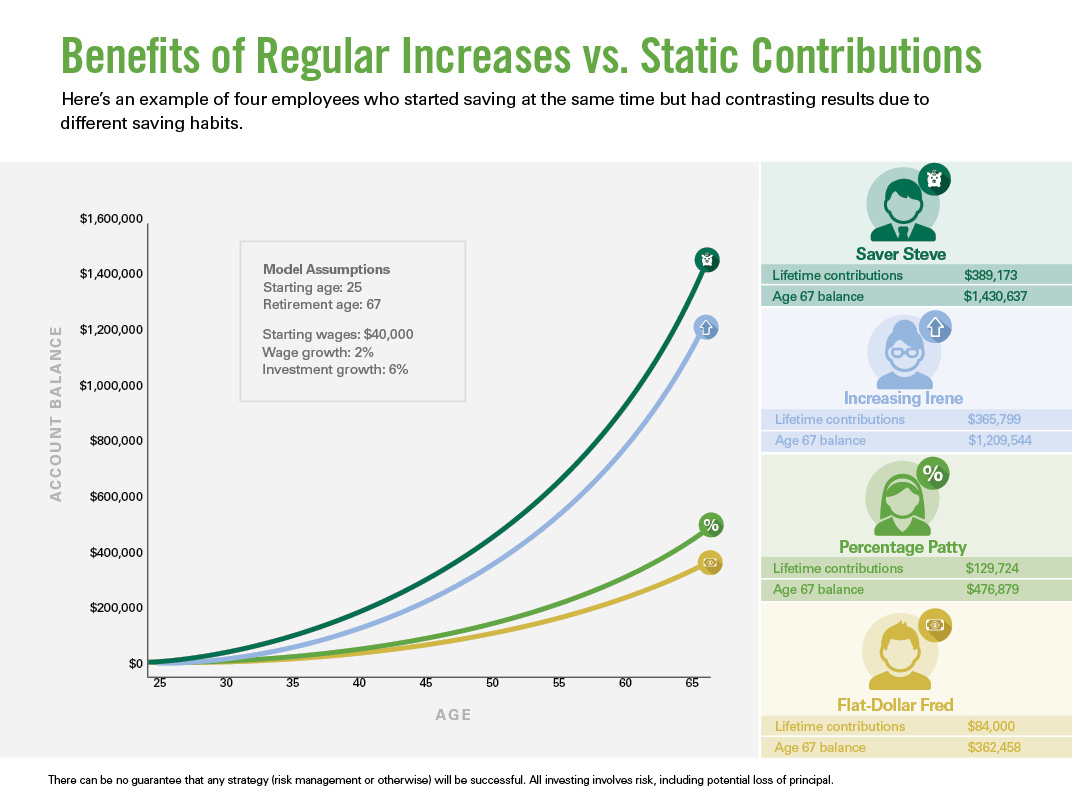

Just ask Flat-Dollar Fred, Percentage Patty, Increasing Irene and Saver Steve — four employees who started saving at the same time but had contrasting results due to different saving habits.

Flat-Dollar Fred simply saved the same, flat dollar amount with no increases over time and no regard for inflation or salary increases.

Percentage Patty set a fixed contribution rate of 5% but never considered increasing her percentage year-over-year.

Increasing Irene set an initial 5% savings rate but increased her savings by 1% each year until she eventually reached 15% (comprised of her personal and employer contributions).

Did you notice the large margin between Patty’s and Irene’s account balances at retirement in the graph below? Percentage increases can make a difference!

Saver Steve started strong with an outstanding 15% savings rate thanks to his personal and employer contributions and stayed there for the long haul.

Make it a goal to increase your contribution rate and take advantage of available employer matching to maximize your contributions as early as possible in your career.

To keep yourself on pace like Increasing Irene and Saver Steve, use milestone events like these as reminders to increase your retirement contribution percentage:

Since your savings are not just going into a savings account but a retirement investment account, they may enjoy the potential of compound growth. Compound growth is the earnings on both your original investment and any interest and dividends your investment earns. That means you can potentially earn interest on interest you have already earned, multiplying it exponentially.

The earlier in your career you start saving for retirement, the more compounding may benefit you. In the above example, it’s important to note that each character started saving something as soon as he or she could — although we should all work toward Saver Steve’s saving habits.

If you wait 10 years to begin saving at 35, the cost of waiting could be higher. But don’t despair — starting late is better than not saving at all.

Saving early provides more than a moment of satisfaction; it can provide essential day-to-day income for the 20 or more years most of us will live after our days of paid service end.

Click here to log into MyGuideStone to review and update your contributions.