Would you ever turn down free money? Of course not!

You may be surprised to know that's exactly what you're doing when you pass on your employer's offer to match your contributions to your retirement plan.

Think about it like this:

If you aren't participating in your employer match, you might be missing out on $1,500 of retirement savings!

Because most employer matches are calculated as a percentage of your salary, the value of that match will increase as your salary increases during your tenure. For instance, if your salary increases to $60,000, your employer match will increase to $1,800 annually.

It is a good idea to consult your employer's Human Resources department to ensure your contributions are high enough to take advantage of the full employer match. Plus, make sure both your contribution and the match are set up as a percentage so they will grow with your salary every year. Flat dollar saving amounts will not optimize your savings in the long run.

As a rule of thumb, financial planners suggest contributing 15% between you and your employer to your retirement plan.

Your employer's contributions — whether matched or non-matched — are made with tax-sheltered dollars — meaning the money goes into your plan before it is subject to taxes. The contributions, along with any earnings, are all tax-deferred, so you won't owe income taxes until you withdraw the money from your account — which is normally after you retire.

In order to receive your employer matching contributions, you must contribute an employee contribution of your own. Your contributions can be either:

Both types of contributions can be helpful tools as you map out your tax strategy. You may be familiar with traditional, tax-sheltered contributions that are tax-deductible in the year earned and defer taxes to when you receive retirement income. The choice of this contribution type is often chosen if a minister plans to claim housing allowance during retirement.

On the other hand, Roth contributions are included in taxable income in the year earned but go a step further than regular, after-tax contributions. Roth contributions boast the attractive feature of tax-free earnings through a qualified withdrawal. Effectively, a participant would pay no taxes at all upon withdrawal of his or her Roth contributions.

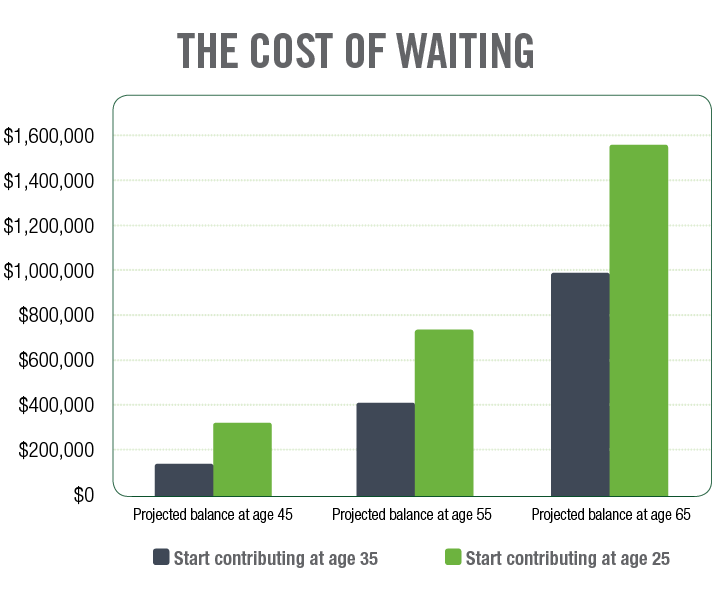

If you wait to start saving, you will miss out on the compound return that can result from your contribution as an investment and your employer's matching contribution as an investment as well as any return on your previous earnings. The extra money can make a dramatic difference in your retirement account balance over time.

This is a hypothetical example that illustrates the future value of regular monthly investments for different time periods. It is based on two 25-year-olds with a starting salary of $50,000, annually increasing by 3% until age 65. It assumes an annual deferral rate of 12% with an average annual return of 6%. It is presented for illustrative purposes only and does not reflect actual performance or predict future results of any particular account or investment.

Ask your employer if matching contributions are offered in your retirement plan. Next, make the most of your match by completing a new Retirement Contribution Agreement and returning it to your employer.