Retirement may seem like a distant milestone when you’re in the early stages of your career. But the keys to tomorrow’s secure retirement lie in your decisions today.

Starting early and staying consistent with your savings can make a significant difference in achieving a stable retirement. If you make small changes now, you may have the freedom to serve the Lord later in your life without worrying about a paycheck.

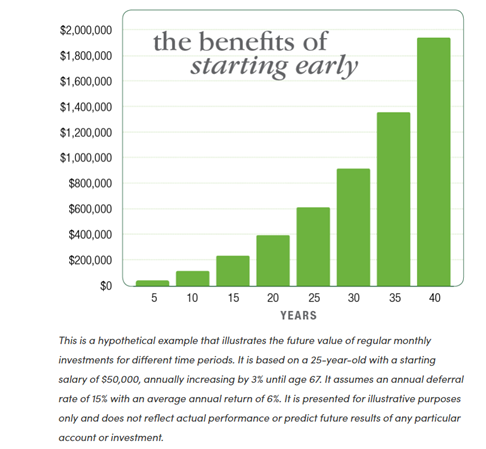

When it comes to saving for retirement, time is on your side. The earlier you start to save, the more time your money has to grow.

Your retirement contributions should be invested in a retirement account so that your savings can experience the potential of compound growth.

Compound growth is the earnings on your original investment and any interest and dividends your investment earns. You earn interest on the interest you have already earned, multiplying it exponentially over the long term.

While it’s never too late to start saving for retirement, starting early has advantages. As a younger investor, you have a longer investment time horizon, which means you can likely ride out short-term volatility and assume more risk in your investments, potentially earning higher returns.

Saving for a secure retirement is a marathon, not a sprint, so consistency is crucial.

It can be tempting to cut back or stop saving during difficult times because financial pressures and immediate expenses can demand priority over long-term goals. But with compound interest, even modest, steady contributions can build into more significant savings over time.

Exerting self-control to save for retirement regularly is challenging, but discomfort today pales in comparison to future regret. A long-term perspective can motivate you to make small sacrifices today and stay on track toward a comfortable retirement.

Many industry experts recommend saving 10-15% of your annual income toward retirement. If this goal seems daunting, here are two saving strategies to consider as you work toward that goal.

Saving early and consistently is the beginning of getting on track for a secure retirement. Don’t wait to take charge of your financial future.

We have several helpful resources and calculators available to help determine where you are and how to get where you want to go.

From the beginning stages of planning your saving and investment strategies to enjoying life in retirement, GuideStone® can help guide you every step of your journey.

For more information, contact us at Info@GuideStone.org or 1-888-98-GUIDE (1-888-984-8433) Monday through Friday, 7 a.m. to 6 p.m. CT, to speak with a customer solutions specialist.

This information is provided for educational purposes only and should not be construed as financial, tax, or legal advice. We encourage you to consult with your own financial, tax, and legal advisors regarding your unique needs and goals.