At some point, most people wonder, “What is the best time to start saving for retirement?" The answer is: as soon as possible! Time is valuable when you’re saving for retirement, especially because of compounding interest. Benjamin Franklin called compounding interest the eighth wonder of the world!

Today, if you started saving $100 per month and averaged 6% earnings in compounding interest year-over-year, in forty years that $100 per month contribution would grow to over $200,000 dollars. By comparison, that same amount saved without compounding interest is only $48,000 dollars. That’s a decrease of 76%!

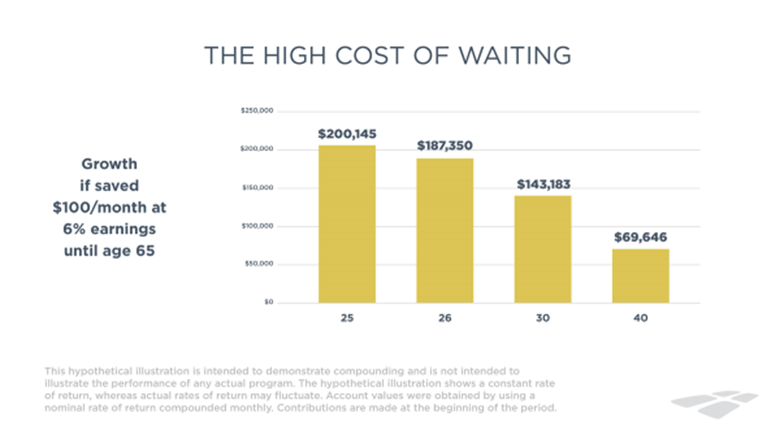

If you plan to retire at age 65, look what happens when you start saving with compounding interest at age 25 compared to age 26. Waiting just one year causes the amount of savings to drop from just over $200,000 dollars to a little over $187,000 dollars. That’s a difference of nearly $13,000 dollars. And the trend continues downward for shorter amounts of time. Wait until you’re 30 years old, and that number is a hair over $143,000 dollars. If you wait until you’re 40, the savings is under $70,000 dollars.

Determine an amount you can afford to save monthly, no matter how little that amount may seem. Contact your organization’s Human Resources representative and ask for a Retirement Contribution Agreement or visit GuideStone.org/RCA to download one today.

Start saving it now! You’ll be surprised at how fast it’ll add up!