Saving for retirement is one of the most important things you can do for yourself.

So, why aren't more people planning for the future? Let's review three of the most common reasons people aren't saving for retirement and why you need to make it a priority today — no matter what.

The truth is you can't afford not to save for retirement. Could you live on $18,000 a year? If you aren't saving for retirement, this is a realistic estimate of your annual income if you only relied on Social Security benefits, which breaks down to $1,514 per month for housing, food, bills, entertainment, health care, etc. — and that's before inflation takes its effect.1

We understand money is often tight and saving for retirement looks like an easy expense to cut out of your budget. But do yourself a favor and reconsider saving even a little bit each month for the future. Your future self will thank you.

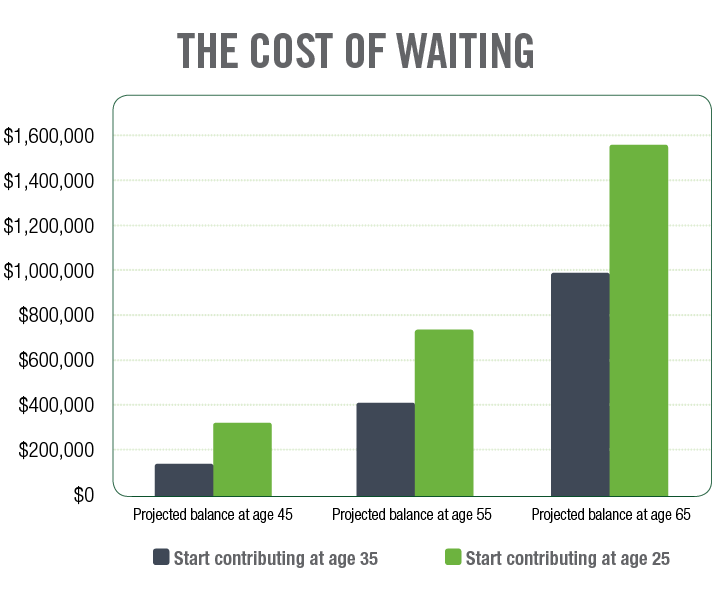

While retirement may seem far away right now, taking steps early in your career has the potential to pay off down the road. Even waiting just a few years to start saving could result in significant lost earnings.

For example, 25-year-old Jeff contributes 12% of his annual salary toward retirement each year. Meanwhile, Adam doesn't start his 12% contribution until he is 35 years old. When they are each 65, assuming a 6% annual rate of return, Jeff will have more than $1.5 million and Adam will have nearly $990,000. Because Jeff started saving earlier in his career, he will have over half a million dollars more than Adam in retirement savings.

This is a hypothetical example that illustrates the future value of regular monthly investments for different time periods. It is based on two 25-year-olds with a starting salary of $50,000, annually increasing by 3% until age 65. It assumes an annual deferral rate of 12% with an average annual return of 6%. It is presented for illustrative purposes only and does not reflect actual performance or predict future results of any particular account or investment.

Remember, it's never too late to take positive steps toward a secure future. Regardless of how far along you are in your career, there is still time to make a difference by starting today. Don't wait any longer — your future is too important.

While it is a blessing that you find fulfillment and joy in your work, it is unrealistic to think you can work forever.

According to a 2019 survey by the Employee Benefit Research Institute (EBRI), 7 in every 10 workers expect to work for pay during retirement, but realistically only 3 in 10 retirees have actually worked for pay in retirement.2 The EBRI attributes this statistic largely to unforeseen health issues and unexpected circumstances at home or work.

No one wants to think about these unfortunate reasons for early retirement, but they are real possibilities to consider. By saving for retirement, you are developing a plan to protect yourself and loved ones against future uncertainties.

Whether you have been using one of these excuses or are facing other obstacles, there is still time to make a positive change. GuideStone® is here to help you take the right steps toward saving for retirement and prioritizing your long-term goals.

Ask your organization about your retirement plan and enroll with your administrator or human resources. If your organization does not currently have a retirement plan, evaluate your options and start today so you can continue to live the life you want tomorrow!

Already in a retirement plan? It may be time to make an annual percentage increase to your retirement contribution. Increase your contributions today.

1Social Security Basic Facts, June 2020, SSA.gov/news/press/factsheets/basicfact-alt.pdf

2Employee Benefit Research Institute, 2020 Retirement Confidence Survey Summary Report, EBRI.org/docs/default-source/rcs/2020-rcs/2020-rcs-summary-report.pdf?sfvrsn=84bc3d2f_7

For more tips and timely information, follow us @GuideStone.

If you have further questions, contact a customer solutions specialist at 1-888-98-GUIDE (1-888-984-8433) Monday through Friday between 7 a.m. and 6 p.m. CT.