Transparency In Coverage

The Transparency in Coverage Final Rule set forth by the U.S. Department of the Treasury, the U.S. Department of Labor, and the U.S. Department of Health and Human Services, requires non-grandfathered group health plans and health insurance issuers offering group or individual health insurance coverage to make available to the public negotiated rates for all covered items with in-network providers, and historical payments to and billed charges from, out-of-network providers through machine-readable files (MRFs) posted on an internet website, updated monthly. These files will permit the public to have access to health plan payment information that can be used to understand health plan pricing and the cost for health care services.

The final rule can be found here: https://www.federalregister.gov/documents/2020/11/12/2020-24591/transparency-in-coverage

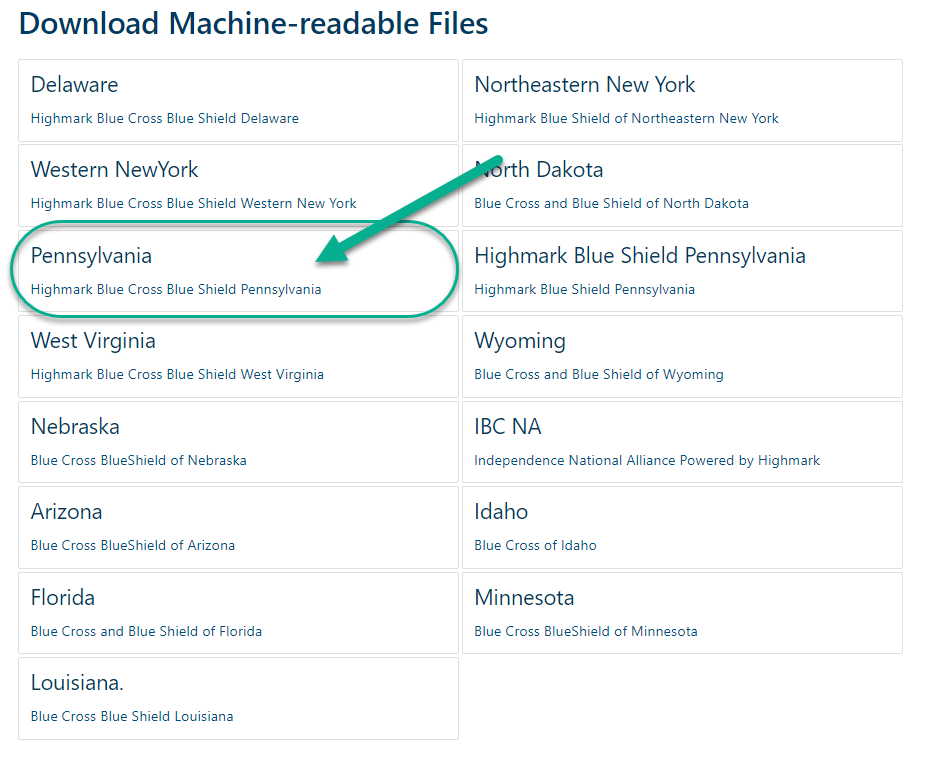

To locate the MRF:

- Navigate to mrfdata.hmhs.com

- Click “Pennsylvania, Highmark Blue Cross Blue Shield Pennsylvania” under “Download Machine-readable Files”

- The file will need to be opened via a webservice that supports JSON files.

Note: Machine Readable Files are very large in size and intended for machine ingestion rather than consumer download.

Members looking for cost comparison information should visit MyHighmark.com or call your Clarity Team at 1-866-472-0924.

No Suprises Act

The No Surprises Act* effective on January 1, 2022, establishes new federal protections against specific surprise medical bills from an out-of-network provider.

Out-of-network is a term used to describe providers and facilities that haven’t signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service, which is called “balance billing”. Please note that the full amount is likely more than the in-network costs for the same service and might not count toward your annual out-of-pocket limit.

The No Surprises Act protects you from surprise medical bills (and balance billing) in three main scenarios:

Emergency Services: When you get covered emergency services from an out-of-network provider or out-of-network emergency facility.

Non-emergency Services: When you receive non-emergency services from an out-of-network provider delivered as part of a visit to an in-network health care facility.

Air Ambulance Services: When you get covered air ambulance services provided by an out-of-network provider.

You can only be balanced billed in these scenarios if you give the provider permission to do so by signing a surprise bill protection form. Please note: You aren’t required to provide permission and shouldn’t sign the form if you didn’t choose a health care provider before scheduling care. Here’s an example of a Surprise Bill Protection form.

Please review Your Rights and Protections Against Surprise Medical Bills notice to familiarize yourself with these rights.

Receiving care from an in-network provider or facility may cost less. If you are enrolled in a GuideStone® medical plan, please call the number on the back of your ID card to find an in-network provider.

Learn more about the No Surprises Act, or if you believe you’ve been incorrectly billed, visit CMS.gov/NoSurprises.

*Title I (No Surprises Act) of Division BB of the Consolidated Appropriations Act, 2021 (CAA) amended title XXVII of the Public Health Service Act (PHS Act)