Choosing a health plan can sometimes feel overwhelming. Is a high deductible right for me? Which plan will cover my prescriptions? Am I free to see any health care provider? These are a few questions that may come to mind as you navigate plan options.

There’s no one-size-fits-all health plan for everyone. That’s why we’ve developed six smart strategies to help you choose a health plan that balances affordability with your health needs and stage of life.

As you consider your plan options, weigh the following factors:

Look at what you spent last year, including doctor’s visits, medications, procedures, surgeries, hospitalizations and medical equipment expenses. Then, consider any changes that you foresee in the following year. Do you plan to start a family? Will you soon be an empty nester? Do you anticipate needing a costly medical procedure? Will you begin a maintenance medication?

The actual cost of health coverage involves how much and what type of health care services you and your family use. Calculate the following:

| TABLE A | Last Year's Actual Costs | Upcoming Year's Estimated Costs |

|---|---|---|

| Primary care physician and specialist office visits | $ | $ |

| Prescription medications | $ | $ |

| Surgeries and hospitalizations | $ | $ |

| Other (medical equipment, procedures, therapy, etc.) | $ | $ |

| TOTAL | $ | $ **Use this amount below in Table C to estimate your overall plan costs. |

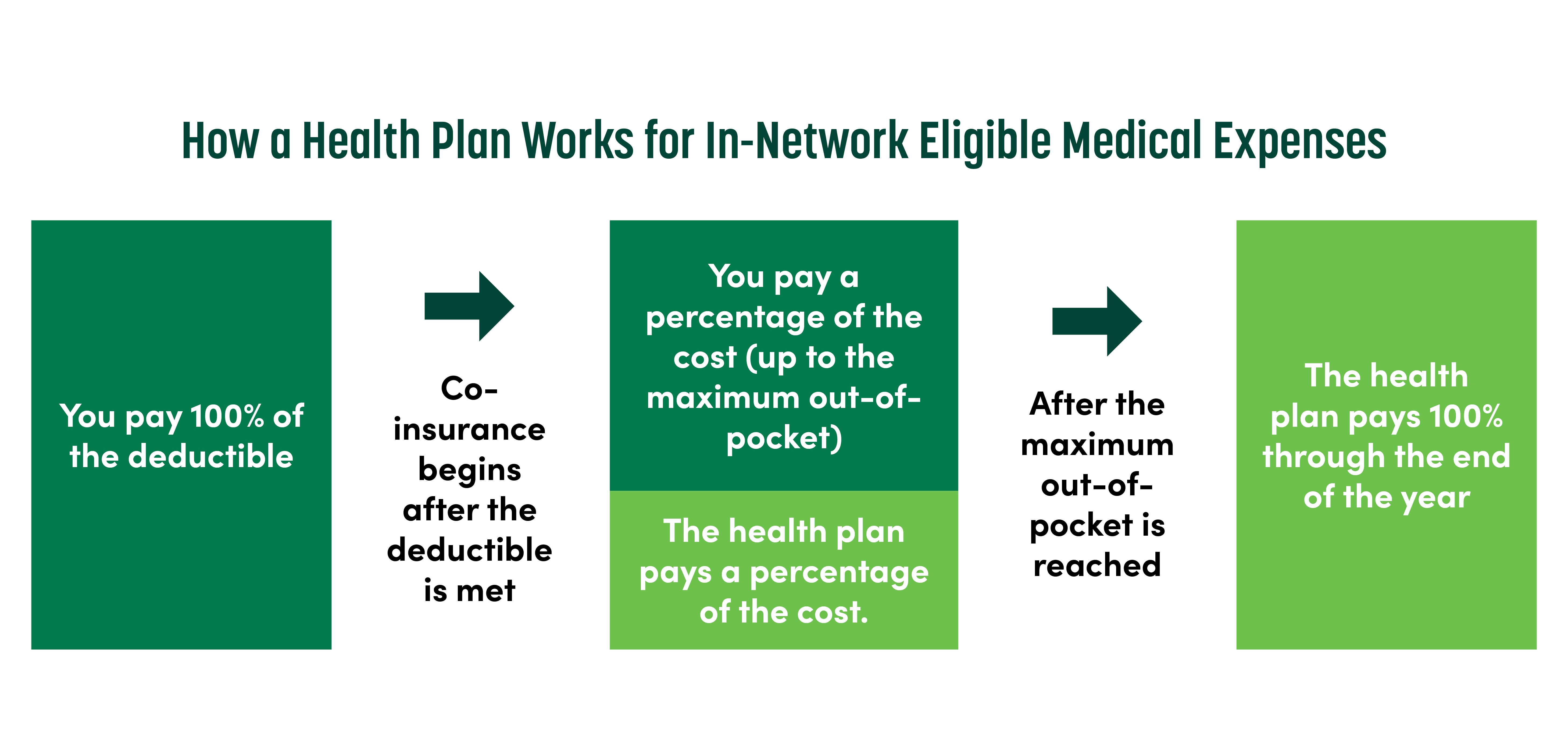

The deductible is the amount you pay out-of-pocket before your plan’s co-insurance kicks in. The lower the deductible, the more the health plan typically costs.

If you rarely meet your medical plan’s deductible, consider selecting a higher-deductible plan. The monthly cost will be lower, and you won’t pay for coverage you may not need.

To determine the deductible that best fits your needs, ask yourself:

The co-insurance is the amount your plan pays for eligible services after you meet your deductible. For example, a plan may have 80%/20% co-insurance. This means that after your deductible is met, the plan will pay 80%, and you’ll pay 20% of future costs. (Plans have a maximum out-of-pocket amount that limits how much you can spend on in-network eligible medical expenses in a year.)

If you don’t usually meet your annual deductible, the co-insurance is a less critical factor. If you do usually meet your yearly deductible, consider your estimated portion of the co-insurance.

To determine a plan’s annual cost, multiply the monthly rate by 12. But remember, this is the cost of having the plan, not using it. You’ll pay this fixed amount each month regardless of whether you’ve used health care services.

Now, determine the total cost of the plan you’re considering.

Deductible + Co-insurance + Annual Cost of Coverage = Total Cost

Here are a few examples to illustrate how the plan components and individual health needs can impact the plan’s total cost.

| TABLE B | |

|---|---|

| Plan Details | Total Out-of-Pocket Costs |

| Example 1: Peter is generally healthy and spent $250 on doctor visits for the year. | |

| Plan A:

$5,000 deductible 80%/20% co-insurance $432 monthly cost |

$250 toward deductible

+ 0 co-insurance + 5,184 cost across 12 months $5,434 Total Annual Cost |

| Plan B:

$1,000 deductible 80%/20% co-insurance $734 monthly cost |

$250 toward deductible

+ 0 co-insurance +8,808 cost across 12 months $9,058 Total Annual Cost |

| Example 2: Paul saw specialists, took several prescription medications and had a major medical procedure for a total of $26,000 for the year. | |

| Plan A:

$5,000 deductible 80%/20% co-insurance $432 monthly cost |

$5,000 toward deductible

+ 4,200 co-insurance (20% of remaining $21,000) + 5,184 cost across 12 months $14,384 Total Annual Cost |

| Plan B:

$1,000 deductible 80%/20% co-insurance $734 monthly cost |

$ 1,000 toward deductible

+ 5,000 co-insurance (20% of remaining $25,000) +8,808 cost across 12 months $14,808 Total Annual Cost |

Now, estimate and compare the costs for the plans you’re considering.

| TABLE C | |

|---|---|

| Compare and Estimate Your Costs | |

| Last Year's Plan | $ actual amount you paid toward your deductible

+ actual co-insurance expenses + cost across 12 months $ Total Annual Cost |

| New Plan

Deductible $ Co-insurance %/ % Monthly cost $ |

$ **estimated total from Table A, up to

the deductible amount

+ estimated total from Table A over the deductible amount, multiplied by the co-insurance % + estimated monthly cost across 12 months $ Total Annual Cost |

If you select a high deductible plan with a lower monthly cost, consider adding the monthly savings into a Health Savings Account (HSA). This is a tax-free way to set aside money for unexpected medical expenses. Funds in an HSA roll over annually, so you’re not at risk of losing the money if you don’t use it. Learn more about the advantages of an HSA account and find more ways to save on health care expenses.

Choosing a health plan can be challenging, so we’re here to help. If you’re considering a GuideStone health plan, call us to walk through your options together. You can also follow our health plan decision guide to identify which plan may best fit your health needs and budget. For more information, contact us at Insurance@GuideStone.org or 1-844-INS-GUIDE (1-844-467-4843), Monday through Friday, from 7 a.m. to 6 p.m. CT.

GuideStone welcomes the opportunity to share this general information. However, this article is not intended to be relied upon as legal advice, tax advice, or medical advice, diagnosis or treatment.